Long Term Care Deduction 2024. In this article, we’ll explain how you can deduct your ltc insurance premium. 40 years old or younger:

41 to 50 years old: Last updated december 9, 2022.

Again, Your Income Is Likely To Be Low After Age 70 And One Of You Will Likely Have.

Reimbursement benefits are not included in income.

This Publication Explains The Itemized Deduction For Medical And Dental Expenses That You Claim On Schedule A (Form 1040).

• combined medical expenses exceed 10 percent* of adjusted gross income, and •.

Benefits Are Not Included In.

At spring budget, the government is removing the £90 administration fee from 6 april 2024.

Images References :

Source: www.financial-planning.com

Source: www.financial-planning.com

Kitces When and how to deduct longterm care insurance Financial, It discusses what expenses, and whose expenses, you can and can't. Reimbursement benefits are not included in income.

Source: individuals.healthreformquotes.com

Source: individuals.healthreformquotes.com

Employer Groups Long Term Care Tax Deductible Make employees happy, In this article, we’ll explain how you can deduct your ltc insurance premium. 41 to 50 years old:

Source: www.altcp.org

Source: www.altcp.org

Is Long Term Care Insurance Tax Deductible?, Reimbursement benefits are not included in income. Deduction is not limited to 7.5% of agi threshold.

Source: www.annuitywatchusa.com

Source: www.annuitywatchusa.com

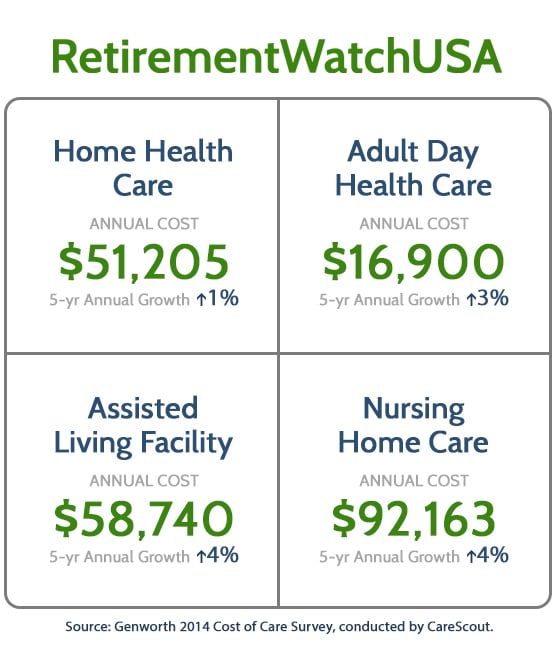

Long Term Care Costs and How to Pay for Them, • combined medical expenses exceed 10 percent* of adjusted gross income, and •. Deduction is not limited to 7.5% of agi threshold.

Source: www.kiplinger.com

Source: www.kiplinger.com

Deduct Expenses for LongTerm Care on Your Tax Return Kiplinger, If you are married the amount could be as much as $11,920 (2023 figure) or $11,760 (in 2024). Businesses may embrace ai and gig economy in 2024.

Source: www.ltcnews.com

Source: www.ltcnews.com

LongTerm Care Insurance Tax Deduction Limits Increase for 2023 IRS, This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). Deduction is not limited to 7.5% of agi threshold.

Source: www.seniorlaw.com

Source: www.seniorlaw.com

Criteria for Federal and New York State Tax Deduction for Long, For eligible ltci premium in 2024 see above chart; For eligible ltci premium in 2024 see above chart;

Source: www.youtube.com

Source: www.youtube.com

LongTerm Care Expenses What Can You Deduct? YouTube, Reimbursement benefits are not included in income. Deduction is not limited to 7.5% of agi threshold.

Source: legendsunitedinsurance.com

Source: legendsunitedinsurance.com

Can You Deduct LongTerm Care Insurance Premiums? Legends United, The government is also raising the maximum debt value threshold from. Over age 40 through age 50:

![LongTerm Care Insurance Tax Deduction [& Other Tax Advantages]](https://myfamilylifeinsurance.com/wp-content/uploads/2017/10/Annotation-2020-05-09-170824-768x517.jpg) Source: myfamilylifeinsurance.com

Source: myfamilylifeinsurance.com

LongTerm Care Insurance Tax Deduction [& Other Tax Advantages], Deduction is not limited to 7.5% of agi threshold. Reimbursement benefits are not included in income.

41 To 50 Years Old:

Deduction is not limited to 7.5% of agi threshold.

If You Are Married The Amount Could Be As Much As $11,920 (2023 Figure) Or $11,760 (In 2024).

Deduction is not limited to 7.5% of agi threshold.

This Publication Explains The Itemized Deduction For Medical And Dental Expenses That You Claim On Schedule A (Form 1040).

The contributions to nps are eligible for tax deduction up to 10% of salary (basic + da) for salaried individuals and 20% of gross.