Estate Tax Table 2024. The faqs on this page provide details on how tax reform affects estate and gift tax. This tax is levied at the federal level, though many states have their own estate tax that would need to be paid in addition to the federal estate tax.

As of 2024, estate income tax rates are progressive, meaning the percentage of income subject to taxation increases as income levels rise. Free estate tax calculator to estimate federal estate tax in the u.s.

If Joan's Deceased Estate Earned Taxable Income Of.

As of 2024, estate income tax rates are progressive, meaning the percentage of income subject to taxation increases as income levels rise.

Unlike The Massachusetts Estate Tax Exemption, The Federal Exemption Is Portable Between Spouses.

Estate tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are.

For 2023, The Threshold Is $12.92 Million For Individuals And $25.84 Million For.

Images References :

Source: brokeasshome.com

Source: brokeasshome.com

Massachusetts Estate Tax Table, That number will keep going up annually with. The new law amended the estate tax by providing a credit of up to $99,600, thereby eliminating the tax for estates valued at $2 million or less and reducing the tax for estates valued at more than $2 million.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, But in 2026, unless the federal. The estate tax is often a topic of concern for those inheriting assets.

Source: gabotaf.com

Source: gabotaf.com

Withholding Tax Table effective January 1, 2023 — GABOTAF, 2 this means spouses can both. In 2025, the estate and gift tax exemptions will increase again, with the amount of the increate dependent on the level of inflation during 2024.

Massachusetts Estate Tax Table, The federal estate tax exemption is $13.61 million for deaths in 2024, up from $12.92 million for deaths in 2023. Federal estate & gift tax the federal estate tax exclusion for decedents dying will increase to $13,610,000 million per person (up from $12,920,000 in 2023) or.

Source: governmentph.com

Source: governmentph.com

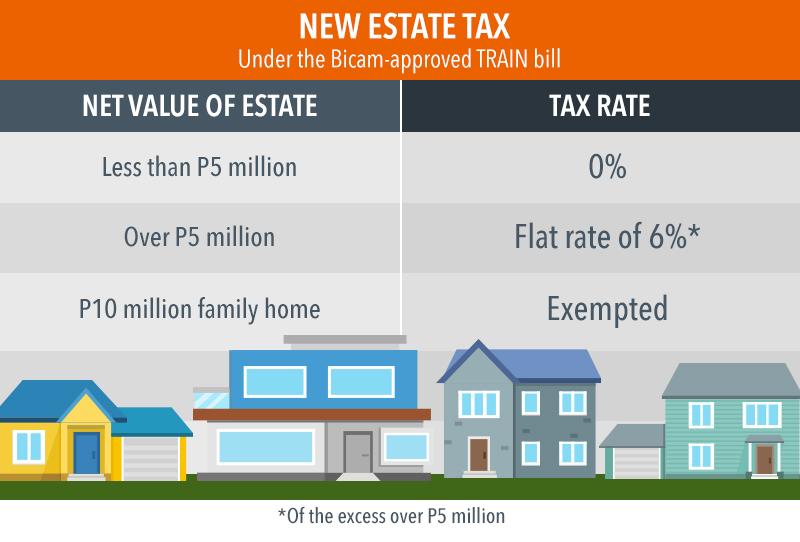

Highlights of Tax Reform Law (TRAIN) See the Tax Rates for 2019, The new york estate tax threshold is $6.94 million in 2024 and $6.58 million in 2023. New york estate tax exemption.

Source: www.harrypoint.com

Source: www.harrypoint.com

Historical Estate Tax Exemption Amounts And Tax Rates, Thirteen states levy an estate tax. Unlike the massachusetts estate tax exemption, the federal exemption is portable between spouses.

Source: www.fi3advisors.com

Source: www.fi3advisors.com

Grantor Retained Annuity Trusts A Unique Estate Planning Solution, Unlike the massachusetts estate tax exemption, the federal exemption is portable between spouses. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Source: thegreen.guide

Source: thegreen.guide

Estate and Gift Tax Update for 2023 / Minnesota Estate Tax Everything, Visit the estate and gift taxes page for more comprehensive estate and gift tax information. The second income year is 1 july 2023 to 30 june 2024.

Source: asenaadvisors.com

Source: asenaadvisors.com

What is the U.S. Estate Tax Rate? Asena Advisors, Home > financial guides and whitepapers > 2024 federal & state estate and gift tax cheat sheet. Estate tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are.

Source: www.rappler.com

Source: www.rappler.com

EXPLAINER What's inside the bicamapproved tax reform bill?, Home > financial guides and whitepapers > 2024 federal & state estate and gift tax cheat sheet. The federal estate tax exemption amount went up again for 2024.

Free Estate Tax Calculator To Estimate Federal Estate Tax In The U.s.

There have been recent law changes to the estate tax for decedents dying on or after january 1, 2023.

If Joan's Deceased Estate Earned Taxable Income Of.

The estate tax ranges from rates of 18% to 40% and generally only applies to assets over $13.61 million in 2024.